Million Peppol Ready E-Invoicing

GST InvoiceNow is now F.O.C. for GST-Registered businesses from 1 Apr 2025 to 31 Mar 2027*

*T&C Apply

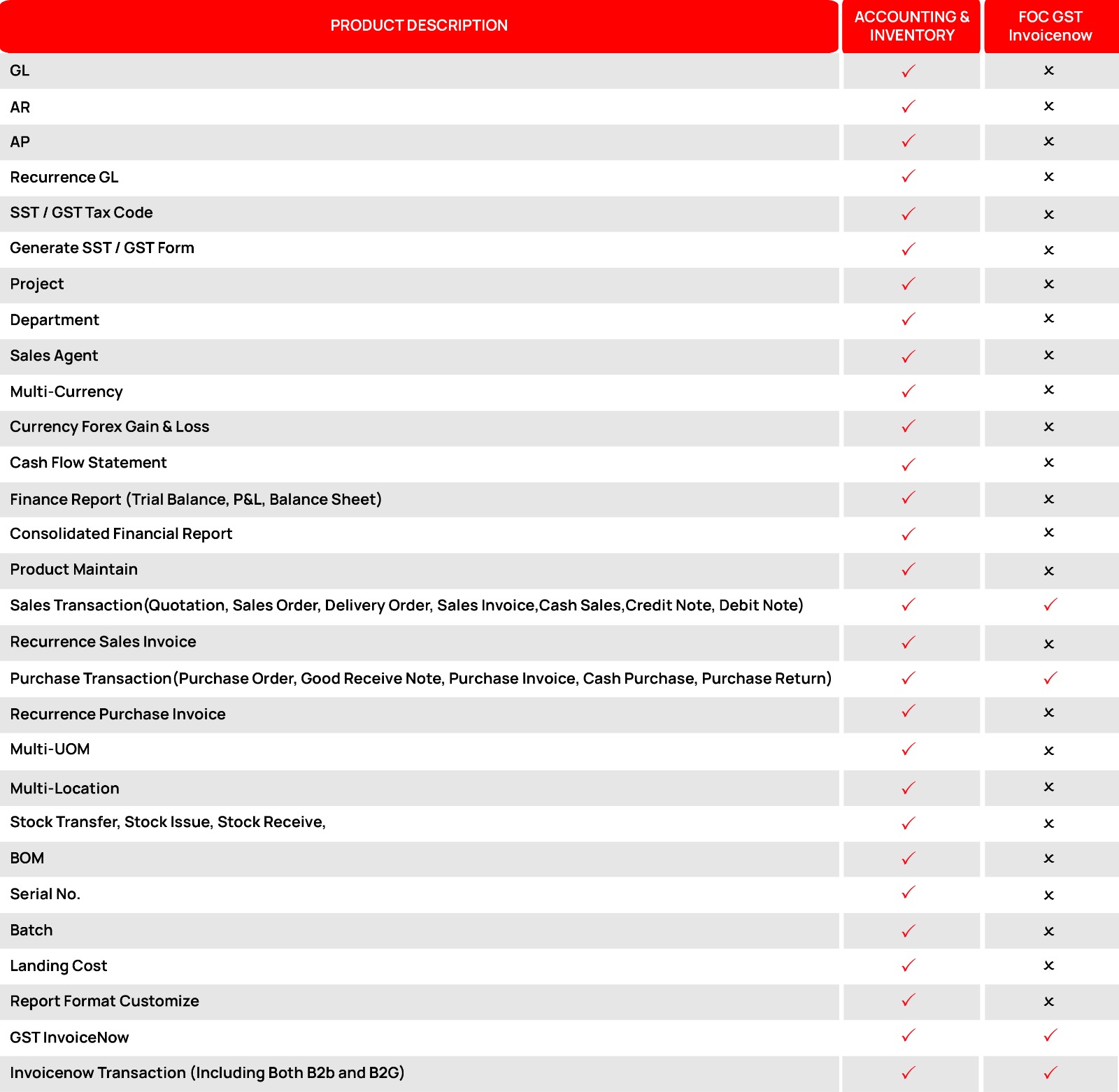

What is InvoiceNow?

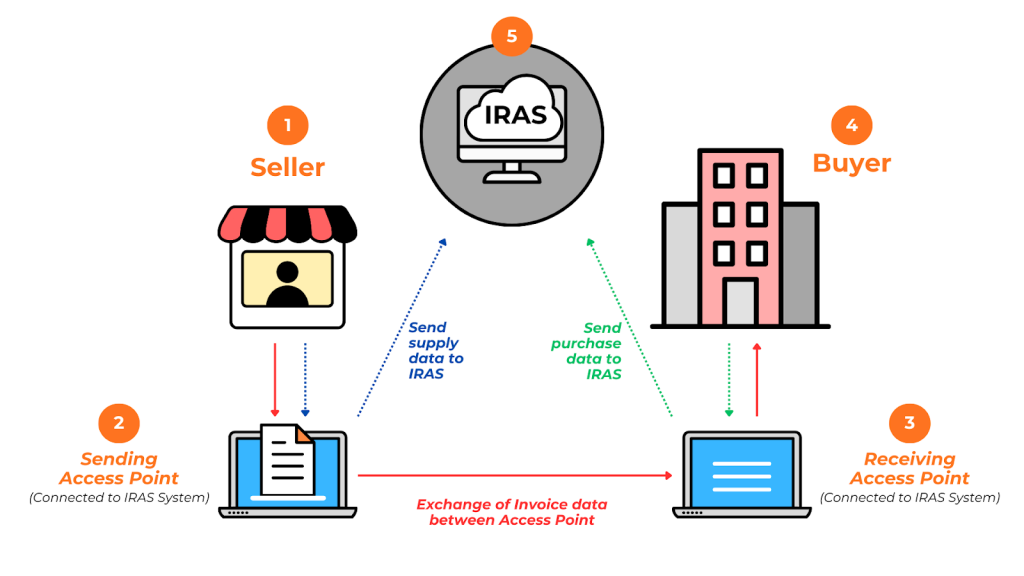

IRAS GST Invoicenow

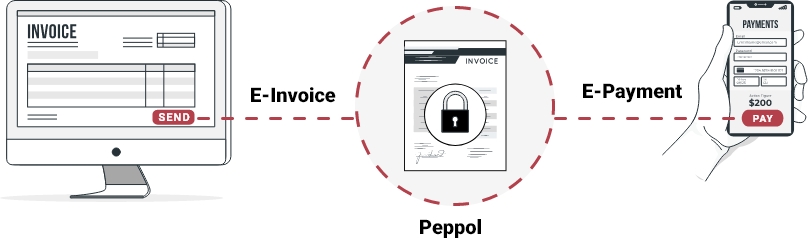

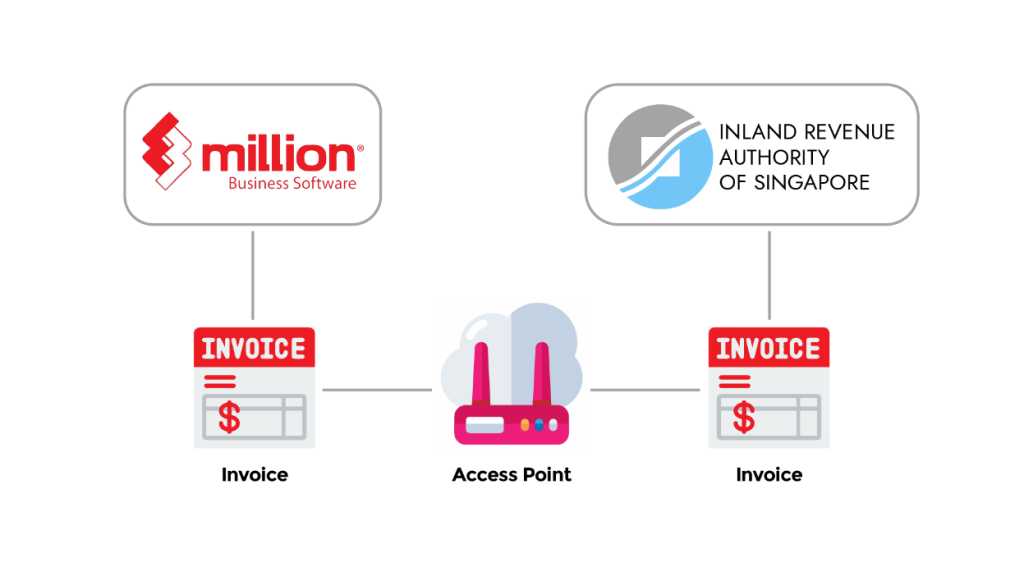

The five points of invoice documents on Peppol Network.

Supplier (Corner 1/C1) → Access Point (Corner 2/C2) → Buyer’s Access Point (Corner 3/C3) → Buyer (Corner 4/C4)

And the Invoice Data shared to IRAS’s System (Corner 5/C5) through C2 & C3

What is GST InvoiceNow?

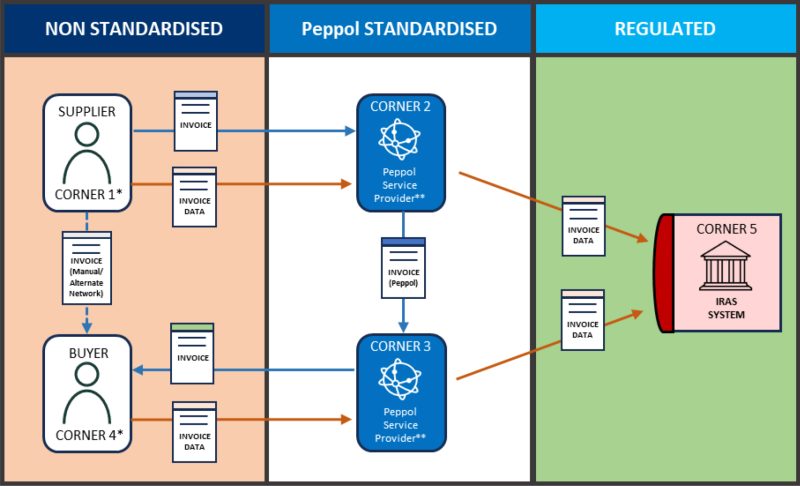

On the Peppol network, an invoice document is firstly created by the supplier (known as Corner 1 or C1), and sent to their Access Point (known as Corner 2 or C2). C2 will send the invoice document to the buyer’s Access Point (known as Corner 3 or C3), who, will then forward the same to the buyer, (known as Corner 4 or C4). Working in conjunction with the Peppol Network, invoice data will be channelled to IRAS system via C2 and C3. To provide better understanding of mechanism for invoice data submission, we have classified each transaction type based on the business’ point of view.

* Corner 1 and corner 4 represent invoice system.

** Peppol Service Provider in this context is an Access Point accredited by IMDA

Save Time Efficiently

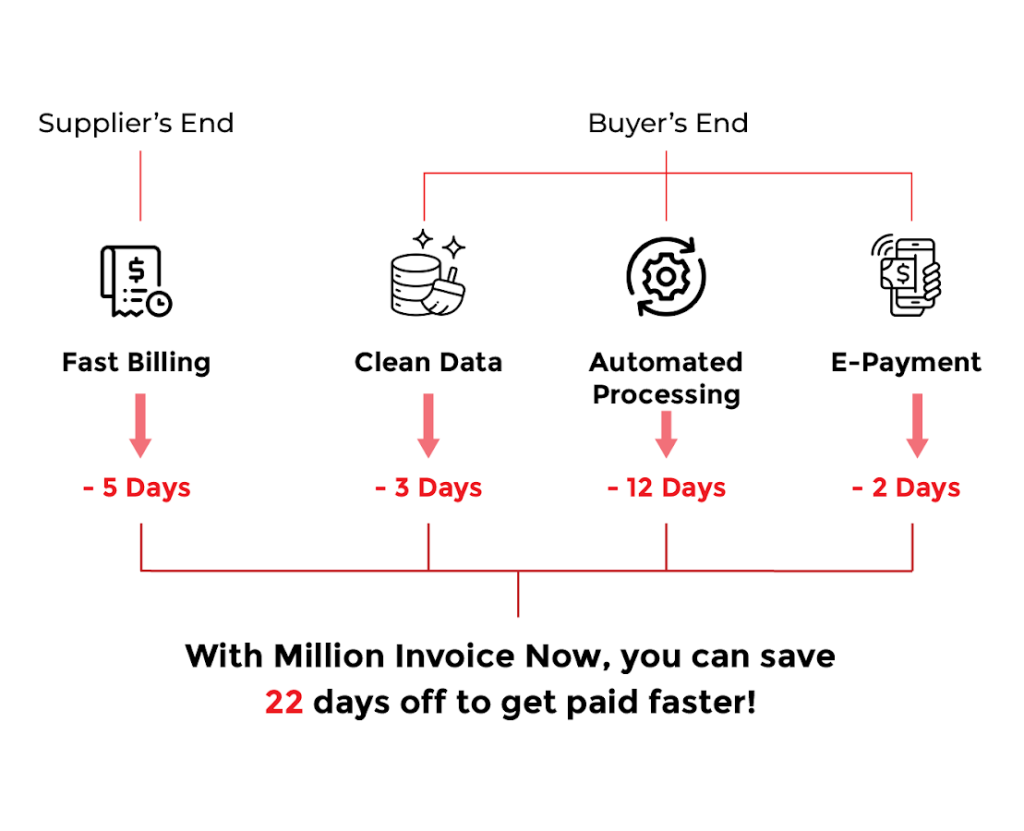

Million E-Invoicing (InvoiceNow) offers a powerful time-saving solution.

For a typical 60-day term invoice processed through the traditional method (excluding financing or factoring), Million InvoiceNow significantly reduces processing time, providing substantial time savings.

- Fast Billing

- Clean Data

- Automated Processing

- Automated E-payment

Million enhances InvoiceNow with AI-powered anomaly and fraud detection, secured by encryption. Simple e-invoices go through instant processing, while complex ones undergo 3- or 4-way matching with supporting data. A real-time dashboard enables close monitoring, reducing delays and improving accuracy.

Benefits of IRAS GST InvoiceNow

Enhanced Efficiency

Minimized Errors and Costs

Optimized Cash Flow Management

Effortless GST Compliance

Accelerated Audits and Refunds

Register for GST InvoiceNow Online Training

Our team will respond to you within 3 working days

"*" indicates required fields